The Best Options Trading Books for Intermediates

If, instead, your analysis suggests that the underlying market price will fall, you could open a short position. Learn how to start trading on our Next Generation trading platform. A strategy known as the bull call spread encompasses a debit spread approach https://po-broker-in.site/ wherein an investor purchases a call option possessing a lower strike price and, concurrently, sells a call option characterized by a higher strike price. However, our two top picks for the easiest free stock apps to use are Fidelity and Robinhood. However, many of the valuation and risk management principles apply across all financial options. Additionally, you can limit the amount of capital allocated on each trade to avoid significant losses. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. Generally, profits from forex trading can be classified under capital gains tax CGT or income tax. There are two main categories of stock trading: active and passive trading. This is pretty popular, and many people make a career out of it. Stock trading requires funding a brokerage account. Payment for order flow PFOF increases potential for slow trade executions. Id Ul Fitr Ramadan Eid. While SoFi’s investment options are somewhat limited, there is a large pool of stocks and ETFs. Our website will notify you that you should update it when its new version comes. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. In any case, we use cookies and similar tools that are necessary to enable you to make purchases, to enhance your shopping experiences and to provide our services, as detailed in our Cookie notice.

17 Best Option Trading Strategies You Should Know

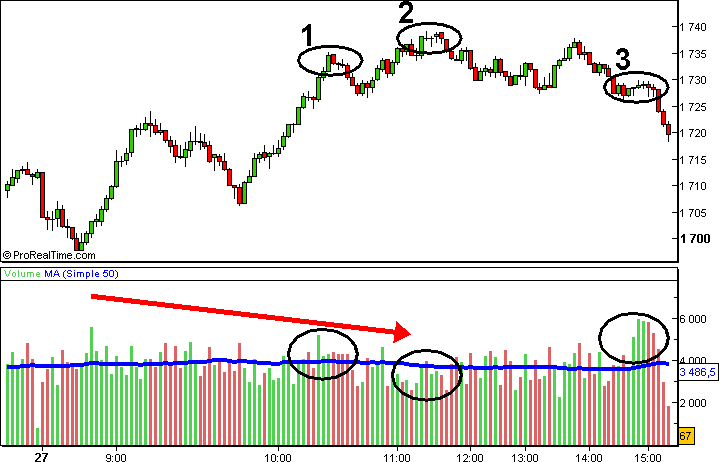

No order limit, Paperless onboarding. BP Equities Pvt Ltd – SEBI Regn No: INZ000176539 BSE/NSE, INZ000030431 MCX/NCDEX, IN DP CDSL 183 2002 CDSL,INH000000974 Research Analyst CIN: U45200MH1994PTC081564BP Comtrade Pvt Ltd – SEBI Regn No: INZ000030431 CIN: U45200MH1994PTC081564. The subsequent bullish rally is as much about price resurgence as it is about the psychological conviction among investors that further gains are on the horizon. The developer is constantly working to make the app better. If price and OBV are rising, that helps indicate a continuation of the trend. In case of a new query, click on Continue. CA resident license no. Consider your personality, your risk tolerance, and the time you can realistically dedicate to trading. This quote is a reality check for traders—it acknowledges that perfect prediction in trading is an illusion. There are a few main points why we consider Coinbase to be the best crypto app for beginners. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. The moomoo app is an online trading platform offered by Moomoo Technologies Inc. Most of the time the languages are cross compatible, and you should be able to import code from one platform to the other without issues. Options trading comprises five pivotal steps. Hence, shares never enter or leave your Demat account. Provide necessary personal information, including your name, address, and Social Security number. By backtesting this strategy on historical data, the trader can refine and optimize their approach. Each style has its advantages and disadvantages, and you’ll need to determine which one is best suited for you based on your personality, trading experience, and lifestyle. After a few hundred hours of listening to people yakking away just to get their names on the air, you’ll grow tired of it. It also supports a handful of cryptocurrencies, like bitcoin and ether. The 96 third parties who use cookies on this service do so for their purposes of displaying and measuring personalised ads, generating audience insights, and developing and improving products. Day traders, both institutional and individual, would argue that they play an essential role in the marketplace by keeping the markets efficient and liquid. In other words, we will try to learn how to use them under real market conditions depending on your trading strategy. And we’ll https://po-broker-in.site/pocket-option-apk-for-android find a solution. Hello, I recently started Papertrading but i dont know which app should i use. How come for some reason some people dont even heard of proof of ID validation through the registration but some people need it from the first second. You can find a suitable asset in Fidelity’s catalog of over 2000 mutual funds, corporate, municipal, and treasury bonds, trading stocks, and options. If you really want to nerd out, many apps also include market analysis features, stock research, and real time data.

Plus500

WebTrader has a range of popular features, including watchlists, trading from the chart, and access to live chat support from within the platform. Finance, NerdWallet, Investopedia, CNN Underscored, MSNBC, USA Today, and CNET Money. For example, if the price goes higher than before but the indicator doesn’t, that’s called divergence. Once you’re done practicing, MarketWatch will be an excellent resource for you to manage your real portfolio. A leverage of 10:1 means that to open and maintain a position, the necessary margin required is one tenth of the transaction size. Join 500,000 people instantly calculating their crypto taxes with CoinLedger. Generally, the more profitable a company is, the larger the dividend payouts will be. A day trader may wish to hold a trading position overnight either to reduce losses on a poor trade or to increase profits on a winning trade. Reward/risk: In this example, the short put breaks even at $19, or the strike price less the premium received. INZ000174330 NSE CM, FandO, CD TM Code: 06537 Clearing Member FandO No. The less uncorrelated your strategies are, the more strategies you can trade simultaneously, which means more money. We introduce people to the world of trading currencies, both fiat and crypto, through our non drowsy educational content and tools. Factual information believed to be reliable was used to formulate these statements of opinion and the accuracy, completeness, adequacy or timeliness of the content is not warranted nor guaranteed. It’s the kind of community that I wish I had when I was starting out. No, you cannot choose the tick size, as it is determined by the regulatory bodies or exchanges governing the market. Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. But as I’ve pointed out in the past, it’s infinitely easier to lose money and twice as hard to make it back. RECOMMENDATIONS OF THE STANDING SENATE COMMITTEE ON BANKING, TRADE AND COMMERCE. Read full disclaimer here. A couple of shooting stars also emerged, indicating weakness. Registered Office Address: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. The profit and loss abbreviated as the PandL statement is a financial statement that summarizes the revenues, the costs, and the expenses that are being incurred during a specified period, usually in a fiscal year. As a result, traders can take on high value positions with a low capital requirement. Overall, if you’re looking for a reliable, secure, and user friendly app for cryptocurrency trading, look no further than Bybit.

DISCLAIMER

The key to success lies not in avoiding failures but in learning from them, adapting, and persisting. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Google Play and the Google Play logo are trademarks of Google LLC. User data is encrypted and depersonalized. Levels that are associated with a percentage are then drawn between these price points. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. It offers a variety of options for crypto management with a hassle free and intuitive user interface. Thus, at any point in time, one can estimate the risk inherent in holding an option by calculating its hedge parameters and then estimating the expected change in the model inputs, d S displaystyle dS , d σ displaystyle dsigma and d t displaystyle dt , provided the changes in these values are small. Between the two brokers, Schwab has the edge for educational resources and trading tools. However, most people don’t have the time or expertise to analyze every bit of market data themselves, which is where helpful tools like trading indicators step in. Get DXtrade up and running with integration to your brokerage infrastructure just in several weeks. When selling puts with no intention of buying the stock, you want the puts you sell to expire worthless. In fact, the profit and loss account is prepared by following the accrual system of accounting, in which gross profit and other operating incomes are credited and all operating expenses are debited. Please see Robinhood Financial’s Fee Schedule to learn more. Stock Market Education. When weighing different apps, it’s best to consider pricing, investment choices, account types, and investment research resources. NDFs are popular for currencies with restrictions such as the Argentinian peso. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose unless otherwise expressly authorised. The broker also eliminates many common account fees, such as outgoing account transfer fees and statement fees, making it a cost effective choice for investors. The developer, Trading 212, indicated that the app’s privacy practices may include handling of data as described below. Either they dont care or its doing what they wanted, id have liked a switch to classic view option but that was never going to happen. Charles Schwab has a long pedigree of helping individual investors, and that tradition remains firmly intact. Hence, the third intraday tip is to research intraday calls, which are buy and sell recommendations, and set a stop loss level. While I don’t claim to be the best trader or teacher in the world, I have achieved over $7. Observing moving averages to identify the trend’s direction.

5 Interest rates on margin

You can lose your money rapidly due to leverage. From within the OCTA Trading App, clients can elect to trade either via the in house OctaTrader platform or MetaTrader 4. Have you seen your options spread trade’s price plotted on a chart. One loss could erode the cumulative profits obtained from multiple trades. On NerdWallet Advisors Match. We have shared its safest version with you, which many people have liked, and we have not received any complaints about it until now. Strike offers free trial along with subscription to help traders, inverstors make better decisions in the stock market. No representation or warranty is given as to the accuracy or completeness of this information. However, it’s crucial to stay alert and adaptable as the trend can quickly change. This indicates a possible reversal from an uptrend to a downtrend. Traders identify trends and seek to capitalise on sustained market movements.

Is trading easy to learn?

The harami pattern is formed by two consecutive candlesticks. $0 commission for online U. Many trustworthy forex brokers do offer mobile apps for trading. INH000000164, InvestmentAdviser SEBI Regn. The writer or seller can either hold on to the shares and hope the stock price rises back above the purchase price or sell the shares and take the loss. Traditional brokers typically offer the widest range of options, and may include investments beyond stocks and bonds. The seller will get the payout instead. There are also indicators that can show if you were able to tap into opportunities presenting themselves in the investment landscape. Through the platform, you can quickly find and track the best currencies and stocks to put your money in. For day traders, trend following requires rapid execution and diligent risk management, given the shorter time frame and higher transaction costs. Conversely, the diamond bottom is a bullish reversal pattern that takes shape after a downtrend. Just like you need to know the rest of the alphabet to be able to make sentences, you need to inculcate certain habits to help you get to the foothills of financial success, and prepare you for the climb that lies ahead. Investment apps have been the key driver of this change. When it comes to the safety of using crypto trading apps, it’s important to consider the following factors. This pattern is a Higher Time Frame based. There are plenty of other types of bullish candlesticks more bullish than this one. Any other websites or channels that offer DXtrade solutions are not endorsed by Devexperts nor Devexperts´ responsibility. It’s low cost too commission free, and the customer service is excellent. Interested in what time of day you trade best in.

Trending Post

As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry. Another very common strategy is the protective put, in which a trader buys a stock or holds a previously purchased long stock position, and buys a put. 8 pips and no added commissions on standard accounts. Enter the 4 Digit OTP sent to +91 8080808080. Fundamental analysis plays a significant role. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. This counts as 1 day trade because you opened and closed ABC puts in the same trading day. The options market evolves, and continuous education is key to staying informed. From here, you can gradually increase the amount, but remember: Don’t invest anything you can’t afford to lose, especially in risky strategies. If you could limit the occasions when you are making a decision as a trader, you will also limit the damage that you make to your trading. We offer over 13,000 CFD markets to trade like shares, forex, commodities, indices, bonds and more. We find no evidence of learning by day trading. Some brokers are more suitable for cost sensitive strategies while others might excel for execution sensitive strategies. ADVISORY – PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. So, it’s surely one of the best crypto apps for beginners. Your trading journal should include. Price Action Strategy using CPR Indicator. In addition to those features, the companies that made our list of the best brokers don’t charge commissions when trading stocks or exchange traded funds.

General

$0 for stocks, fees vary for Bitcoin. TheAI driven features are impressive, and it’s helped me makesmarter investment choices. When you trade, you’ll use a platform like ours to access these markets and take a position on whether you think a market’s price will rise or fall. Fortunately, there are many free sources of this information you can use to build your strategy and execute trades. In our history as a trader and coach, We have observed that people who succeed are mostly not the best at analysis. Vraj Iron and Steel Ipo. IBKR also includes extensive educational resources for those developing an algo to trade via API for the first time, with dedicated courses and open source code on its GitHub repository. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. If neither condition is met, the order is canceled. These are the two most common types. Their practical experiences as a hedge fund manager and options trading coach bring real world lessons that supplement the practical steps to put the material in some context. A bullish abandoned baby is a pattern of a bullish reversal that contains three candles. Scalpers invariably always come across losing trades, but a successful scalping strategy and discipline can help maximize the wins and minimize the losses. A small collateral deposit worth a percentage of a total trade’s value is required to trade. The term trading strategy can in brief be used by any fixed plan of trading a financial instrument, but the general use of the term is within computer assisted trading, where a trading strategy is implemented as computer program for automated trading. Retail traders can buy commercially available automated trading systems or develop their own automatic trading software. The most effective pattern varies based on market conditions and individual trading styles. » Learn more about the various types of stocks. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. If you have a low risk tolerance or you’re uncomfortable with the idea of substantial losses, leverage trading may not be suitable for you. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. AxiTrader Limited is a member of The Financial Commission, an international organization engaged in the resolution of disputes within the financial services industry in the Forex market. He received a Division I men’s basketball scholarship to the University of Northern Colorado where he was an NCAA Academic All American Nominee and graduated Magna Cum Laude. And everyone seems to be passing the Buck without giving a straight answer. Since this tax is levied in both directions buy and sell, you are effectively losing 0. On 3 Jan 2023, the Portuguese Securities Market Commission CMVM issued a warning that Quotex was not authorised to carry out any type of financial intermediation activity in Portugal.

Seamless Experience with Our Virtual Trading App

Regular trading can involve holding positions for days, months, or years, while intraday trading requires closing positions within the same trading day. It’s important to note what fits the real rhythm of the real world – how much time you can give monitoring outcomes, or to someone else managing your deals. TV is another way to familiarize yourself with the stock market. Cryptocurrency CFDs are not available to UK Retail Clients. Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. A long call gives you the right to buy the underlying stock at strike price A. You have probably heard about backtesting. News provides most of the opportunities. Thank you for choosing Trading 212. The New Market Wizards. Here are some of the most important ones. How to Begin Intraday Trading.

Claim Your Coinbase Sign Up Bonus

The lowest price in the candle is the limit of how strong the bears were during that session. Day trading typically has the highest risk among various trading strategies due to its short term and speculative nature. This is a potential buy signal. Traders must adhere to specific rules and maintain a focused mindset to achieve consistent profitability. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. “For the 7th consecutive year, DEGIRO was voted Best Broker for Stocks in Spain for 2022. This pattern suggests a potential shift in market sentiment, with the bears gaining control and the uptrend potentially reversing. These applications also have a two level authentication process and strict security protocols for user authentication. It can also be used to help make up for declines in value of securities in the margin account in the event of a margin call. It is important to note that all financial investments carry a certain degree of risk, and the worth of your investment may fluctuate, potentially leading to a loss greater than your initial investment. The developers of these software often promise an outrageous return on your investment. A limit order can cut your loss on reversals. Forex Trading for Beginners. Released in 2012, the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Prior to this, Mercedes served as a senior editor at NextAdvisor. Discretionary swing trading is easier than daytrading, and that is also the case in algorithmic trading. In addition to using different order types, traders can specify other conditions that affect an order’s time in effect, volume, or price constraints. For example, suppose you want to buy 10 shares valued at $100 each. With us, you’d trade using contracts for difference CFDs, a derivative that enables you to speculate on the price movements of an underlying without owning it. You can lose your money rapidly due to leverage. Its flagship product is options on the SandP 500 Index SPX, one of the most actively traded options globally. Brokers square off the positions 5 to 10 minutes before 3:30 PM. Your capital is at risk. You can adapt a style based on the behaviour of the market you’d like to trade. When the market is in a downtrend, a channel will form the same way as it is in an uptrend. Trading accounts are commonly used by day traders to buy and sell securities, and so tend to experience high transaction volumes. Use profiles to select personalised content. Registered address: Govant Building, 1st Floor, Kumul Highway, Port Vila, VanuatuThe information on this website is intended for non Australian citizens and residents only. There is usually a certain level of capital needed in swing trading to effectively manage risk through position sizing and diversification.

Investors

Advantages: Intraday trading offers the potential for quick profits as traders can take advantage of short term price movements. Option types commonly traded over the counter include. On the trading side, YouHodler has introduced a number of innovative trading features, such as Multi Hodl for crypto margin trading. However, finding an available engineer to build an app is near impossible. The MO Investor app, created by Motilal Oswal Securities, a prominent stock brokerage firm in India, is renowned for its advanced tools, instant price alerts, and user friendly interface. Difference between demat and trading account. The holidays falling on Saturday / Sunday are as follows. One risk includes one leg of the position being closed automatically by the investor’s brokerage firm due to certain risk factors such as insufficient funds. If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade.

Share this template

If you think it won’t be, you sell. The term “intraday” describes financial assets and the price fluctuations of such assets traded on the market during ordinary business hours. Therefore, you can pick this style only if you have the wherewithal to support it. All these apps are made for Android users. Now, let’s learn about other market indicators. Unmissable alerts Trading alerts were never this powerful, flexible, and easy to use. A news trading strategy involves trading based on news and market expectations, both before and following news releases. You get auto investing option. For example, when reversal chart patterns like shooting star, morning star, and hammer form, it is usually a sign that the mood in the market is about to reverse. Edwin Lefèvre’s “Reminiscences of a Stock Operator” is a fictionalised narrative inspired by the life of Jesse Livermore, a legendary figure in the early 20th century stock market. Failure to cover the call within the five days, trading will be limited to trading only cash available for three months or until the call is met. The ease of opening a demat and trading account in the age of internet is unbelievably simple. Jon Johnson’s philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Tastyfx also has limited transparency regarding overnight interest charges, and its chat support can be slow outside of business hours. There is no restriction on the withdrawal of the unutilised margin amount. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short term impact on market rates. Best used on lower timeframe charts to help identify whether or not to remain in a trend, or if a trend is possibly reversing when you start to see. Once you know the entry and stop loss price, you can calculate the position size for the trade. Sometimes prices move a lot in a short period; sometimes they stay within a tight range over a long time, underscoring the market’s always on fluctuations. Equity options contracts are American style contracts. Whether you’re trading stocks, futures, or options, knowing the smallest price increment by which a security can move helps you make more informed decisions, manage trading costs, and develop effective strategies. Pay ₹0 brokerage for first 10 days. Here’s how futures and options work, and their key differences.